What went wrong?

This week we discuss what went wrong with market darlings, understand why family offices have a tough time hiring, and re-experience the 2010 flash crash.

Dear Clients and Friends of Farrer 36, we are pleased to bring you the Farrer 36 Blog, which includes our latest posts, data, and general articles/videos we find interesting. Happy reading and happy investing!

Disclaimer - This newsletter is for informational purposes only. None of the below should be considered investment advice nor solicitation for investment. Please see full disclosures at the end of this newsletter.

Brand Update

We have officially changed our company name from Farrer Wealth Advisors to Farrer 36 Asset Management. While we began with a focus on wealth advisory, our business has evolved significantly over the years — the new name reflects who we are today. Thank you all for the support over the years, onward and upwards!

Latest Blog Post

What went wrong?

I was going through my ‘watch’ list the other day and noticed something interesting — several so-called ‘popular’ stocks have lagged the S&P 500 over the past five years, some by a pretty wide margin. That got me curious. These names were generally seen as high-quality businesses and long-term compounders, so what went wrong?

To dig in, I thought it’d be useful to run a quick three-layer check — usually the simplest way to figure out why a stock has outperformed or underperformed.

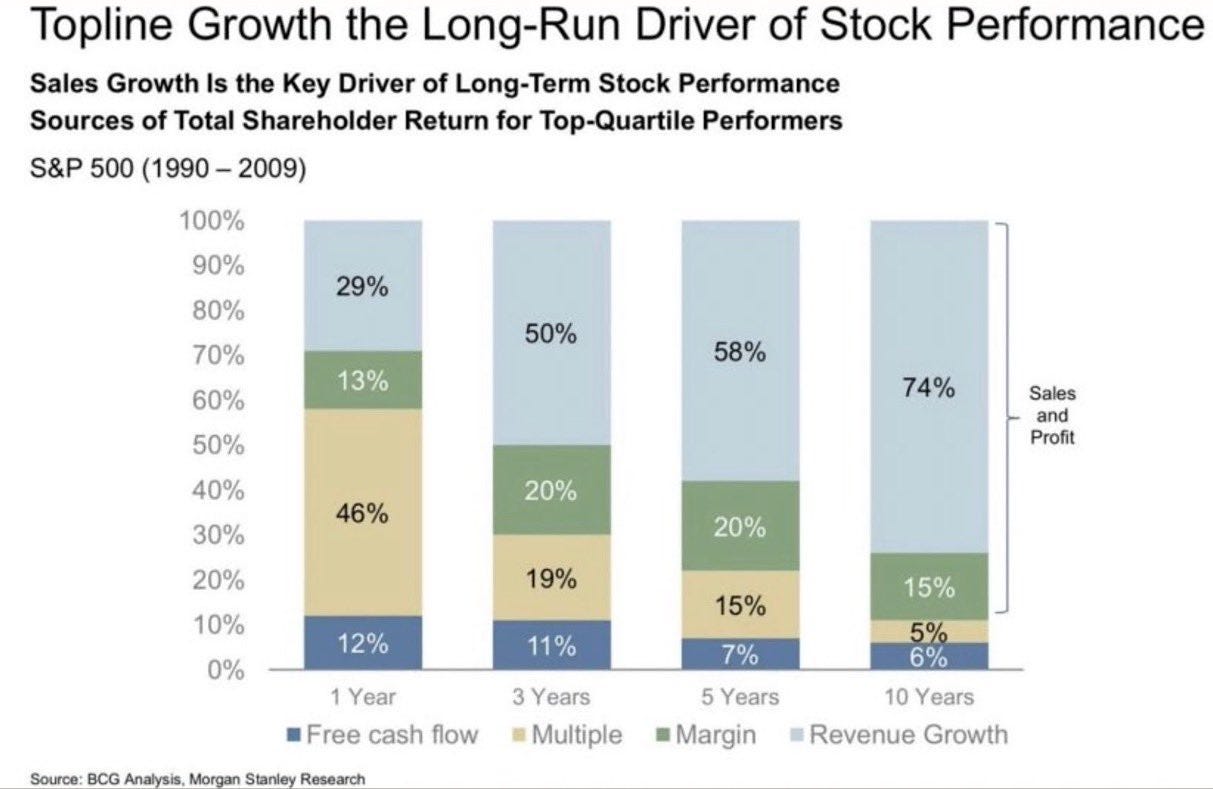

How has revenue grown over the given time-period: As much as value investors try to hate on growth investors, revenue is paramount ingredient in long-term stock performance.

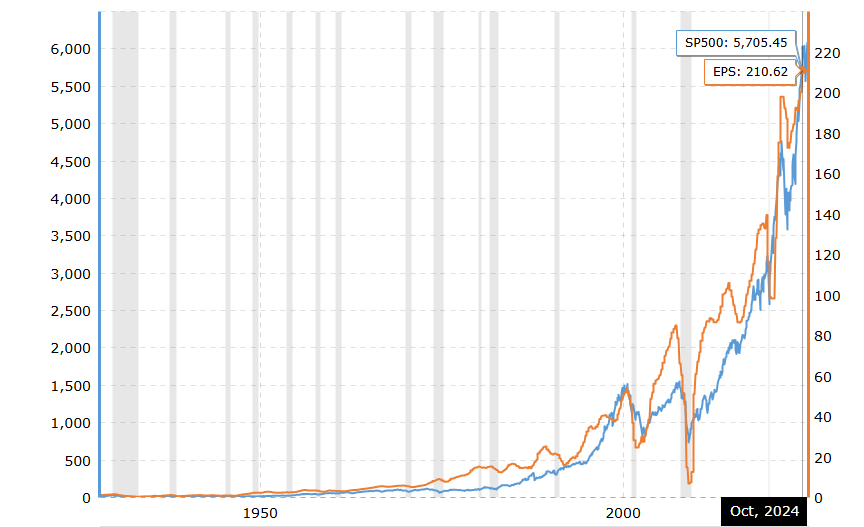

How has EPS compounded: The late, great John Bogle wrote about this frequently — over the long run, EPS growth tends to track pretty closely with stock performance. And no, this doesn’t contradict the earlier point. Unless there is a situation where costs are rising faster than revenue, growing revenue usually drives EPS up — one feeds into the other. Bogle’s broader point was that over long periods, valuation multiples matter less, and what really drives returns is how much a company has compounded its earnings per share.

The multiple: If over the past five years you see that both revenue and EPS has compounded well, then inevitability, a negative result is due to the multiple contracting. Often though, the contraction of the multiple is due to more qualitative factors, and analyzing those is where the fun is.

For each of the companies below, I’ll break things down using the three factors mentioned earlier, and add some quick thoughts on what might be going on. For instance — if revenue’s falling, is it because of increased competition or just bad strategic calls? If revenue looks fine but EPS is slipping, is cost control the issue? And if the multiple’s come down, what’s driving that? Is it something industry-wide? Or are returns on capital and overall efficiency just not what they used to be?

Just a few notes here:

The below list came through some personal observations + Grok’s suggestions based on the most mentioned stocks on X.com over the past five years

I’m using just S&P 500’s price action as a comparison. Total returns would likely make the gap bigger as most of the below stocks do not pay a dividend (or have a yield less than the S&P 500).

As a reference over the past 5 years (2019-2024) the S&P has grown its revenues ~38%, EPS by ~62% and seen its multiple expand by ~27% (23x to 29x).

Unless stated otherwise, revenue and EPS growth figures are based on the most recent full fiscal year compared to the fiscal year five years prior. For valuation multiples, the comparison was a bit trickier due to distortions during the COVID period. In some cases—such as Starbucks—I’ve used the end of 2019 as the starting point for the multiple to better reflect pre-pandemic valuations.

All charts below were drawn using data as of close on 25-Jun-25 (for example, Nike’s recent price action is not reflected)

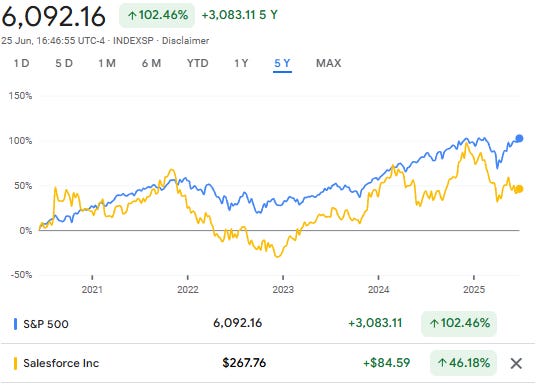

Salesforce - an expensive leader

Salesforce is a dominant company in CRM, ecommerce infra, data and marketing, run by a legendary founder. However, the stock has struggled to keep pace with the broader market.

Past 5 Years:

Revenue Growth -> 122%

EPS Growth -> 241%

Multiple: 60x -> 23x

It’s obvious here that the reason the stock has not performed is due to a significant multiple contraction. Here are my thoughts as to why that contraction has occured:

While revenue has more than doubled, the growth rate of late has decreased. Salesforce exited 2019 growing at nearly 30%, but that growth has fallen to 9%. A 60x multiple can only maintain itself if the revenue growth rate stays rapid.

Despite the margin expansion, returns on capital still look underwhelming. Sure, they’ve improved from the low single digits five years back, but even now they’re hovering around 10% at best. You could make a case that returns might keep improving and that could justify a higher multiple, but generally speaking, high multiples are reserved for businesses that either generate consistently high returns on capital or are growing rapidly —or ideally, both.

Capital allocation: Qualitatively, I know Salesforce has taken heat for some of its acquisitions—MuleSoft, Tableau, Slack—all of which haven’t really played out the way the market was hoping. And when the market thinks a company’s been sloppy with capital allocation, the usual reaction is... punish first, ask questions later.

It seems that 5 years ago Salesforce was priced to perfection, and execution while good, has not been perfect, thus the underperformance. It does seem now however, that the stock is now at a much more reasonable valuation making it an intriguing study going forward.

Nike - a failing giant

Nike needs no introduction, except to say that the business seems to have struggled over the past few years. Considering its historical performance and storied brand this is quite surprising, so lets look at the numbers.

Past 5 Years:

Revenue Growth -> 31%

EPS Growth -> 59%

Multiple: 35x -> 20x

Nike has done a decent job maintaining margins and buying back shares, which has kept EPS growing—albeit slowly—even as its multiple has come down around 40%. But the main culprit here is revenue. Growth has been tepid, and in the most recent fiscal year, revenue declined by 10%. Over the past five years, Nike has made a few unforced errors—one of the biggest being its decision to pull inventory from e-commerce platforms (a move it has since reversed), which opened the door for competitors like On, Hoka, and Lululemon to gain share. Inventory also ballooned, leading to heavy discounting. Add in CEO churn, a sluggish brand, and a weaker discretionary market, and it's no surprise sales have suffered. For Nike to get its groove back, we’re going to need to see a meaningful rebound in revenue—but with the street expecting another down year, investors are anxious.

Starbucks - a bump in the road?

I don’t know any other company that has made more money charging customers 20-40x for a product they could easily make at home than Starbucks. But with a sprawling retail empire and a membership program that is the envy of all F&B businesses, Starbucks has enjoyed several decades of solid stock performance. However, the past 5 years has come with issues, and a new CEO is trying to reverse its fortunes. Let’s dig into the numbers.

Past 5 Years:

Revenue Growth -> 36%

EPS Growth -> 17%

Multiple: 30x -> 34x

This one’s a bit of an odd case—Starbucks has seen mildly increasing multiples, which isn’t what you usually get when a stock has underperformed. What is also interesting is that revenue has compounded at high single-digits (albeit flat growth this past fiscal)—so the business isn’t exactly growing fast, but it’s not falling apart either.

The real drag seems to be slowing same-store sales and maybe getting a bit too aggressive with expansion in China. New CEO Brian Niccol (joined late 2024) has kicked off a “Back to Starbucks” plan—tightening the menu, adjusting pricing, and doubling down on handcrafted drinks and coffee innovation. The street is expecting a pickup in growth down the line, but for now, this still feels like a ‘show-me’ story. What’s curious, though, is that the multiple hasn’t cracked—which might mean that the market’s betting this is just a temporary lull and that the turnaround is in the offing.

SoFi - A fallen SPAC

SoFi is a financial services company that operates mostly in the US but also has operations in LATAM, Canada, and Asia. I don’t know too much about this company, having always lumped it into the category of “banks pretending not to be banks” but it seems to be a popular stock in the Twitterverse. So, let’s look at the numbers.

Past 5 Years:

Revenue Growth -> 362%

EPS Growth -> NA (only became GAAP profitable in FY24)

Multiple (P/S): 17x -> 5x

So, what went wrong with the business? Honestly, not much. Revenue’s exploded over the past five years, and the company’s even turned profitable. Yet, the multiple has collapsed. This feels more like a case of market hubris—remember, the stock ended its first trading day back in Dec 2020 at a 16.5x revenue multiple. I did a quick scan through the news and financials to see if there was anything major that would justify the drop, but nothing really stands out. The one real hit was SoFi’s big student loan refi business—when the Biden admin paused repayments, that leg took a hit. But the rest of the business looks like it’s more than made up for it.

I think this is one of those cases you chalk up to being a victim of Chamath Palihapitiya’s hubris (he’s the one who SPAC’d SoFi). The IPO was just priced way too high. Even now though, the valuation isn’t exactly a bargain—the stock’s trading at 54x forward P/E, and for a business putting up just an 8% return on equity, that feels... expensive.

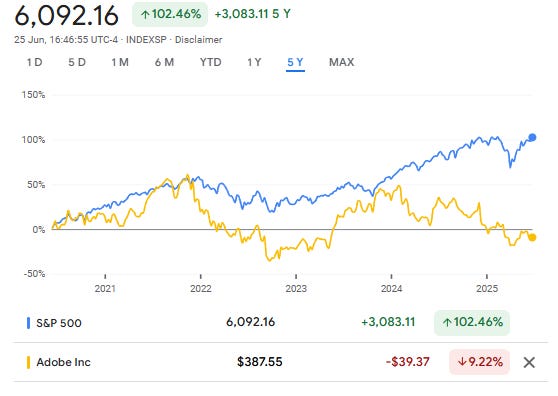

Adobe - an eroding moat

Adobe was a stud of a company and has increased its returns on capital from about 5% 10 years ago to over 46% now! Yet, it’s stock has struggled, woefully underperforming the index over our analysis period.

Past 5 Years:

Revenue Growth -> 92%

EPS Growth -> 172%

Multiple: 56x -> 25x

Looking at Adobe’s double-digit revenue and EPS growth, you’d think the stock would be on a tear — but instead, the multiple has been cut in half. That tells you this is less about fundamentals and more about a shift in narrative. While growth has slowed somewhat from earlier highs, it's still solid. The problem is perception: there's a growing view that Adobe’s innovation has stalled, and that its core products are vulnerable to disruption from newer players like Midjourney, Canva, and others. Adobe’s attempt to acquire Figma — which regulators blocked — only reinforced the idea that it’s running out of organic levers for growth. AI, in general, has made the future murky for companies like Adobe, and you can understand investors refusing to pay much of a multiple until more clarity is uncovered.

Alibaba - losing efficiency?

BABA’s problems are well-known at this point. That said, I’d always chalked most of it up to macro headwinds, regulatory overhang, and the whole Jack Ma saga. But the numbers below tell a slightly different story—looks like we’re seeing a clear drop in operating leverage, with EPS growing much slower than revenue.

Past 5 Years:

Revenue Growth -> 95%

EPS Growth -> 23%

Multiple: 27x -> 15x

Given the slide in operating margins, it’s no surprise the multiple’s been chopped in half. The core business is still solidly profitable, but moves into logistics, stiffer competition in cloud, and some pretty aggressive local players have clearly taken a toll. For context, EBITDA margins were north of 30% back in 2019—they’ve now slipped to 20% as of the last fiscal year. Meanwhile, PDD’s gone the other way, improving its margins by over 34 percentage points in the same time frame.

Grab - an unprofitable leader

Investors had high hopes for Grab when it was SPAC’d by Altimeter Capital. As the dominant ride-hailing and delivery app in Southeast Asia, Grab had a wide runway to grow the market and grow its shareholder returns. However, the numbers below paint an interesting picture.

Past 4 (2020-2024) Years:

Revenue Growth -> 496%

EPS Growth -> NA (Grab is yet to post annual GAAP profitability)

Multiple (P/S)*: 16x -> 4x

*Multiple is from listing (2 Dec 21) till now

I’ve written a few times about what I think has gone wrong with Grab (you can read previous posts here and here). To summarize though, a sky-high SPAC valuation, a lack of profitability, and a struggling fintech business all play a part in the weak stock performance. This is all before expected competition in ride-hailing and delivery toward the end of this year.

Sea - finding its path back

Sea is the other Southeast Asian darling that has struggled over the past five years. But, as you’ll see below, it’s stock performance is more a result of valuation than financial performance.

Past 5 Years:

Revenue Growth -> 673%*

EPS Growth -> NA, Sea only turned profitable in 2023.

Multiple (P/S): 20x -> 5x

*Using GAAP revenue

As the data above shows, Sea’s done a solid job scaling over the past five years. They’ve even turned the corner on profitability—hitting close to 12% EBITDA margins last fiscal year, up from -3.4% in 2020. The problem was the stock just got way too ahead of itself in 2020. Then came a series of hits: Free Fire banned in India, Shopee pulled out of multiple markets, and TikTok Shop started making serious inroads across Southeast Asia.

That said, Sea’s handled each of these reasonably well. All three business lines—Ecommerce, Gaming, and Finance—are now profitable and growing double digits. So while the last five years have been bumpy, the next five could be a very different story if they keep executing.

PayPal - a fading star

For a while PayPal was ubiquitous with online payments, but the service is facing significant competition from other acquirers and wallets.

Past 5 Years:

Revenue Growth -> 79%

EPS Growth -> 50%

Multiple: 52x -> 16x

The first thing that jumps out at you is how expensive PayPal used to be. In fact, the stock regularly traded at 50x trailing for the few years before COVID. Perhaps this was justified, with the company putting up between 15–20% revenue growth consistently for a few years, but that growth has now collapsed to low single digits, making the earlier multiple laughable. This seems to be one of those cases where competition has eroded market share, and this has led to significant internal turmoil (CEO departure, activists, etc.). The new CEO has boasted that PayPal’s new features would “shock the world”; however, this claim has fallen on deaf ears, as the market seems to view PayPal as a melting ice cube.

Etsy - an undercut marketplace

Etsy for years has had a goal to “keep commerce human” emphasizing the importance of human connection in its marketplace. However, over the last few years, this tagline has not resonated with customers, and the stock has underperformed.

Past 5 Years:

Revenue Growth -> 243%

EPS Growth -> 242%

Multiple: 54x -> 35x

Looking at the above numbers, one would struggle to understand why the stock has performed so poorly. In this case though, we need to zoom in a little, and what we can see is that revenue growth really fell off a cliff in 2022 (just as the stock price peaked, as you can see from the chart above) and has dropped to low single digits this past fiscal. The reason behind this—and this is some speculation on my part—is that with the rise of cheap e-commerce (Temu/SHEIN), consumer preferences were laid bare. It didn’t matter where the product came from; rather, it mattered how much it cost. Etsy has an uphill battle to fight here, as once consumers find a ‘substitute’ for your product at a lower cost, they rarely come back.

In Summary:

There were a few interesting takeaways from the above. First—and probably the most obvious—is that price matters. A lot. Some of these companies actually performed well on the business side but still got their stock’s hammered because the multiple got too rich. Second, I was a bit surprised by how much of the underperformance was actually fundamental (BABA being the standout example)—so it wasn’t just a shift in narrative. And lastly, it looks like a group of previously beaten-down names might be fertile ground for future winners. Several of these businesses are humming along nicely, and now that valuations have come back to earth, they might actually be set up for a strong run.

Thanks for reading and happy investing!

Chart of the Week

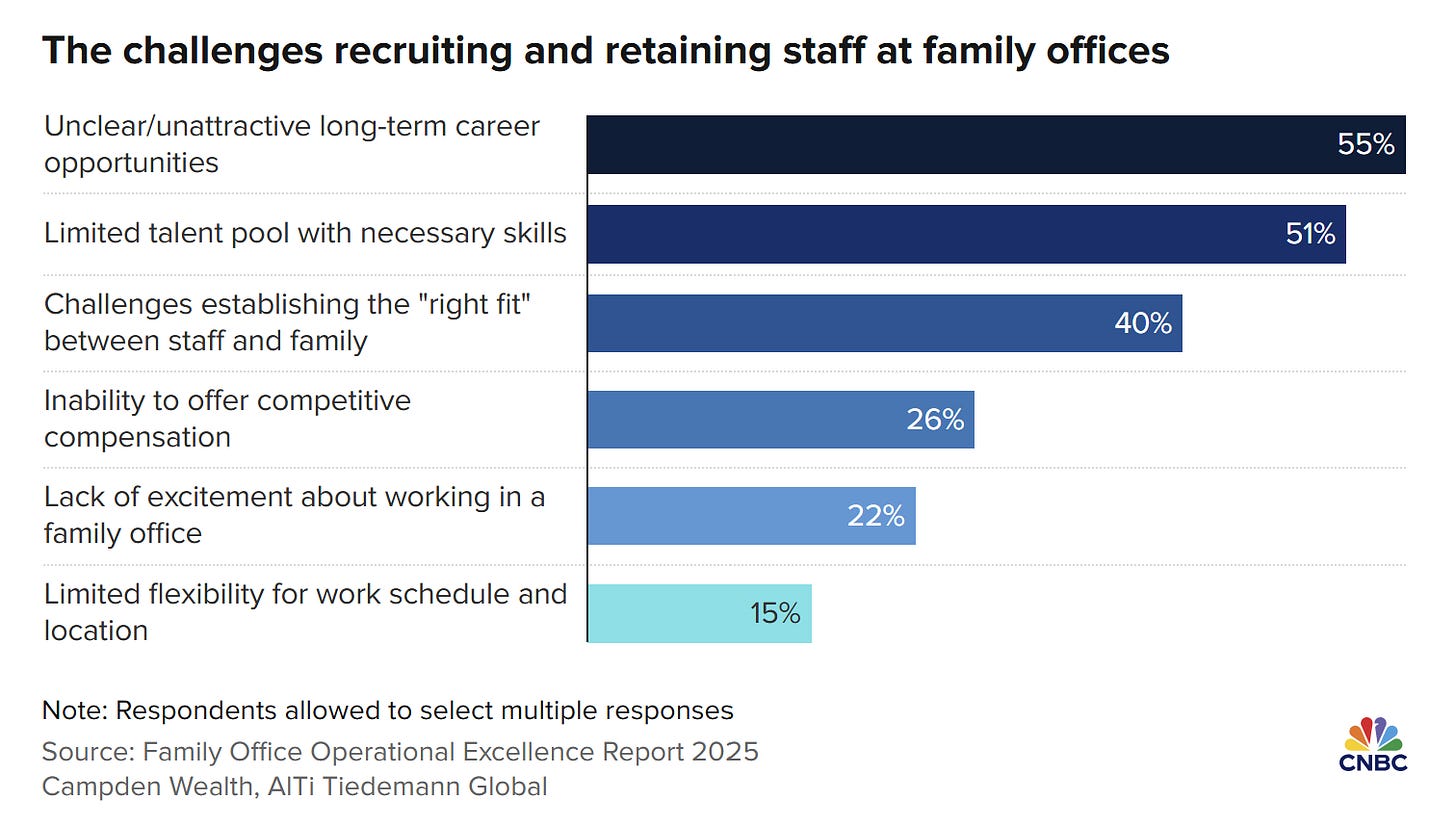

No ladder to climb - Family offices struggle to recruit staff. Seems like upward mobility is highly important for employees. (source)

Links of the Week

A book I was reading referenced these CNBC segments that covered live, the 2010 flash crash. It’s broken into a few parts but Part 4 is where the crash reached its peak and Part 5 is where the recovery happened just as quickly. Its a fascinating watch.

Interesting data covering the ecommerce market share by operator in Southeast Asia. Shopee maintains its dominance.

I really enjoyed this Stanford interview featuring Ken Griffin. I especially liked his focus on sales in the early stages of building Citadel.

For you gambling nuts, this was an excellent overview of the Hacksaw IPO. A fascinating business doing 30%+ revenue growth with 80% operating margins.

This was an illuminating podcast into all things China. I particularly liked the section about how the CCP views AGI as an opportunity and a threat.

A kind request - if you enjoyed this newsletter, I would be most grateful if you could give it a ‘like’ or share it. Thank you!

Good Analysis