2021 Redux?

This week we find out if we've reached the market top, discuss if Google is mission critical, and share some very bad advice.

Dear Clients and Friends of Farrer 36, we are pleased to bring you the Farrer 36 Blog, which includes our latest posts, data, and general articles/videos we find interesting. Happy reading and happy investing!

Disclaimer - This newsletter is for informational purposes only. None of the below should be considered investment advice nor solicitation for investment. Please see full disclosures at the end of this newsletter.

Follow up

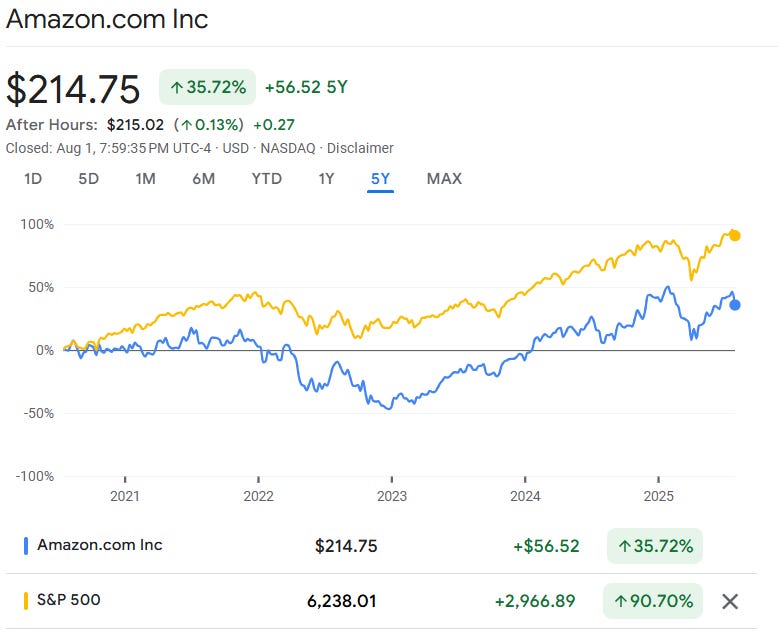

Before we get started on this week’s post (“2021 Redux?”), I wanted to do a quick add-on to my previous post (“What Went Wrong”) in which we discussed why popular stocks had underperformed the S&P 500 over the past 5 years. Kicked myself for this, but I left off the most popular stock of them all:

Amazon:

Past 5 Years:

Revenue Growth -> 127%

EPS Growth -> 380%

Multiple: 145x -> 37.5x

Amazon’s financial performance has been undeniably stellar, but I think the stock just got way too hot during the Covid era. I remember reading debates online about how to value Amazon back then—some argued P/E didn’t make sense since the stock had never really traded on it, and that EV/EBITDA (which was around 40x at the time) was a better metric. But post-Covid, Andy Jassy ramped up infrastructure investment, and eventually, the accounting for that—mainly depreciation—had to catch up. So the lackluster performance since could simply reflect investors recalibrating the stock’s valuation now that earnings matter more.

Latest Blog Post

2021 Redux?

note: this post was written Friday morning, 1st August, Asia time.

Given the absolute rip in Meta and MSFT post-earnings (don’t get me wrong—results were stellar), markets hitting all-time highs, crypto back in fashion, and the VIX at year-to-date lows, I couldn’t help but wonder: are we heading into 2021 part two? For those who remember, 2021 marked the peak of the last cycle, which ended in a pretty brutal 2022 with the market dropping 25% peak-to-trough.

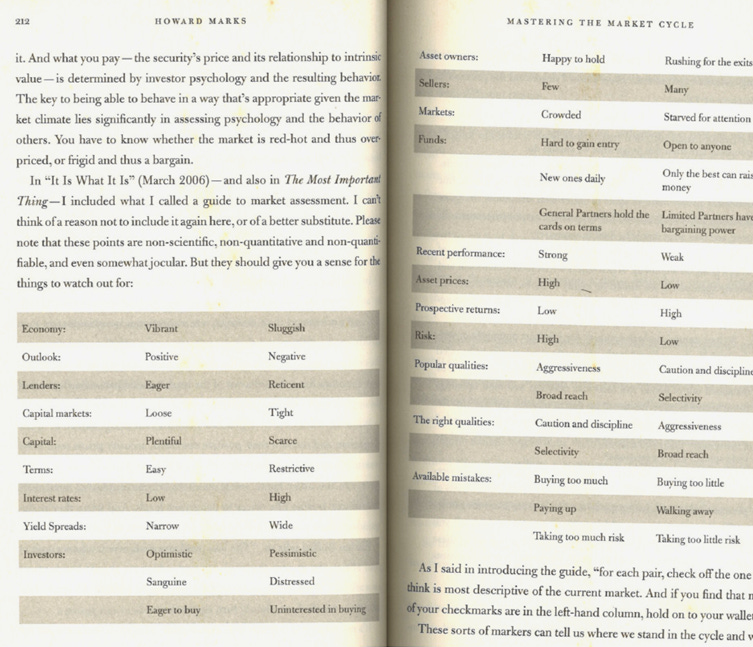

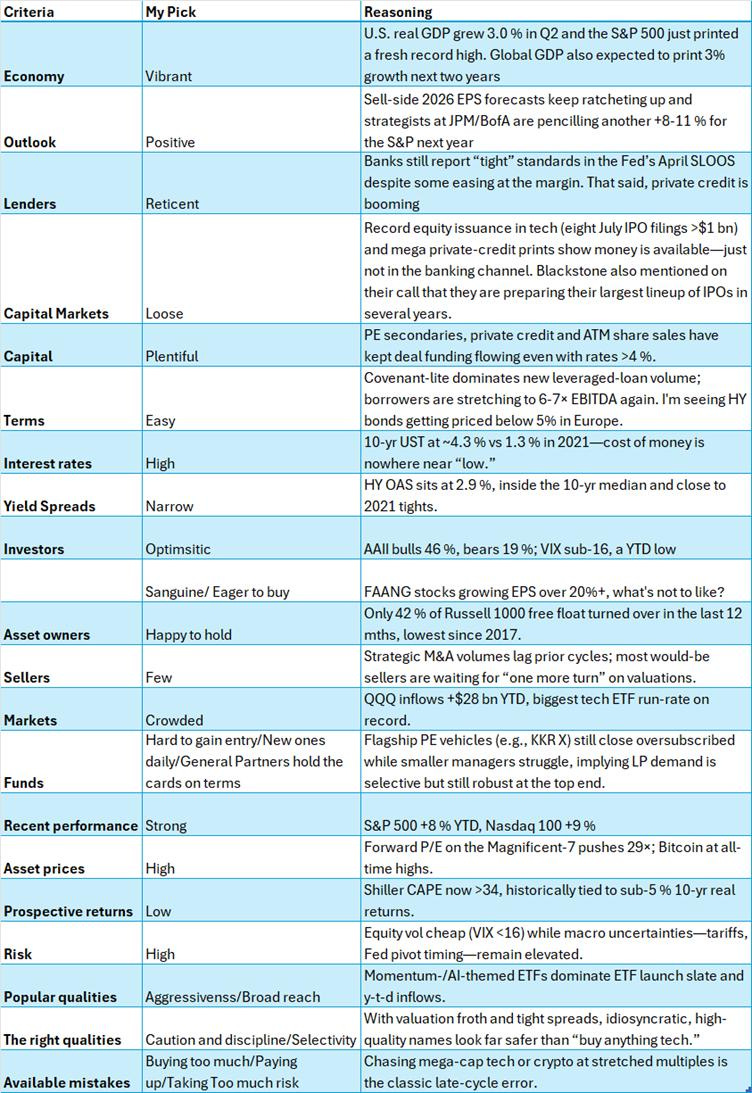

One framework I’ve found surprisingly reliable for gauging where we are in the cycle is from Howard Marks’ book Mastering the Market Cycle. He lays out a broad checklist that helps assess cycle positioning. The more responses you tick on the left-hand column, the closer you likely are to a market peak.

Below are my results—but obviously, feel free to run through the exercise yourself. It’s always a bit of a judgment call, but I’ve found that keeping it as data-driven as possible (rather than going off gut feel) gives a much clearer read on where we are in the cycle.

My results were pretty clear—almost all my responses landed on the ‘left’ side of the table, pointing to a toppish market. The only domino left standing is interest rates, but once that falls, a market peak usually isn’t far behind.

A few caveats, though. First, even if we’re at a ‘peak,’ the peak phase can drag on. The party doesn’t stop right away—it can go on for months, even years. So this isn’t a signal to sell everything, just a reminder to stay cautious. Second, 2021 was a different beast—SPAC mania, NFTs, unprofitable companies trading at 20x+ Price/Sales, Clubhouse valued at $4 billion! We’ve got our own flavors of excess now (FartCoin still has a market cap over $1 billion), but I haven’t seen the same level of madness. Yes, you can point to Mag 7 concentration, but most of these businesses are delivering on earnings. Still, it’s worth watching—markets often need that final stroke of insanity before they snap back to reality.

The idea that we’re entering (or already in) the final phase of the cycle—despite a backdrop of Trump’s tariff talk and two regional wars— does make me scratch my head. But rather than fight the trend, I’ve kept the portfolio steady and layered on some catastrophe hedges. I don’t know when the crash comes—but I’d like to be at least partially covered when it does.

Thanks for reading and happy investing!

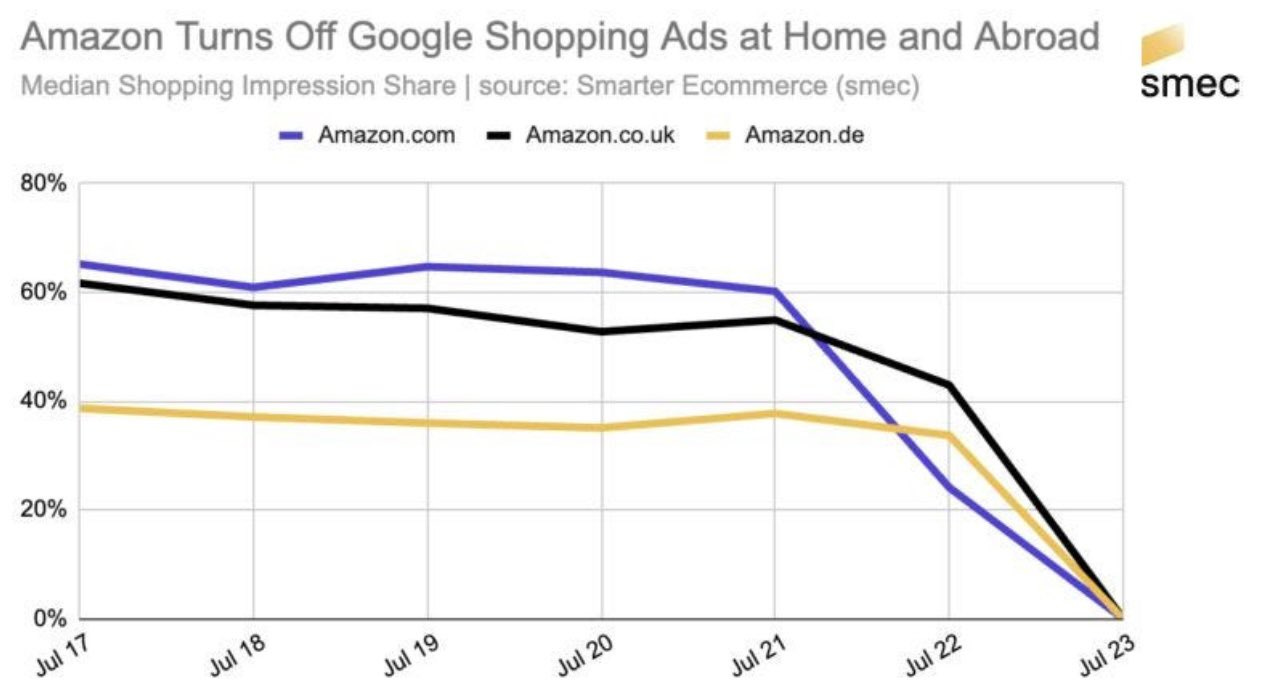

Chart of the Week

Not dead after all? Turns out Google is still highly relevant in shopping decisions. (source)

Links of the Week

Here is a list of very bad advice.

I loved this episode of In Good Company about contrarian investing.

The flipside of Meta’s stellar results.

An excellent 101 about the various types of equity compensation.

I’ve written several times about the consequences of a declining global population - data from Japan starts to paint a bleak economic picture.

A kind request - if you enjoyed this newsletter, I would be most grateful if you could give it a ‘like’ or share it. Thank you!